In this Fi Money Review, we’ll take a closer look at this fast-growing neobanking app — exploring its features, benefits, and what makes over 3.5 million users in India trust it for smart, secure, and rewarding digital banking.

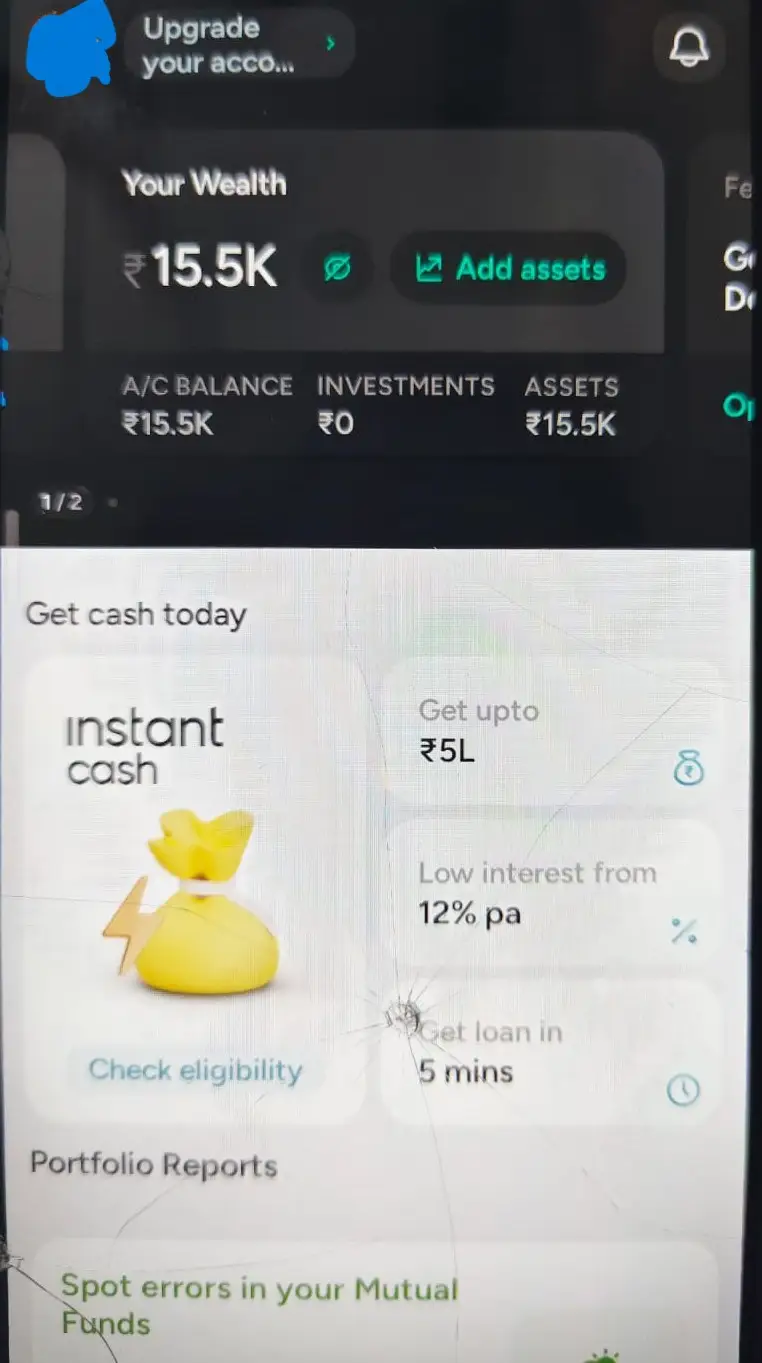

We’ll also explore the app’s newly launched card features and understand why millions of users trust it for their daily financial needs. One standout feature is how effortlessly Fi Money lets you manage all your assets in one place. You can even start an SIP or invest in US stocks with as little as $1, directly through the app.

This is not a promotional review — it’s a fact-based analysis backed by data and insights from authentic financial sources, ensuring you get a clear, unbiased picture of how Fi Money really performs. I’ve personally tested Fi Money for over a month to understand its performance, usability, and reward system — and this review is based on hands-on experience rather than just specs.

We will also analyze this app using the Sleeping Earner Trust Scale.

Without wasting any more time, let’s dive deep into this detailed Fi Money review and see whether it truly lives up to the hype.

NOTE: Fi Money is primarily designed for working professionals. It may not be suitable for students, homemakers, or individuals who are currently unemployed.

What is the Fi Money app?

Fi Money is a modern banking app built in partnership with Federal Bank and Visa. It works just like a regular savings account — but with a smart twist. With Fi, you can easily manage your money, track every expense, and even earn rewards whenever you spend.

What makes Fi special is its use of artificial intelligence (AI) to simplify how you handle your finances. The app studies your spending habits and helps you save smarter. And if you’re someone who wants to grow your money beyond India, Fi also lets you invest in U.S. stocks through its forex account — all within the same app.

As of 2025, the Fi Money app has crossed 10 million downloads and maintains an impressive 4.2-star rating on the Google Play Store — a strong indicator of user trust and satisfaction.

According to recent reports, the platform now has over 3.5 million active users who rely on Fi Money for their everyday banking and investment needs. That’s quite a remarkable figure for a relatively young neobanking platform.

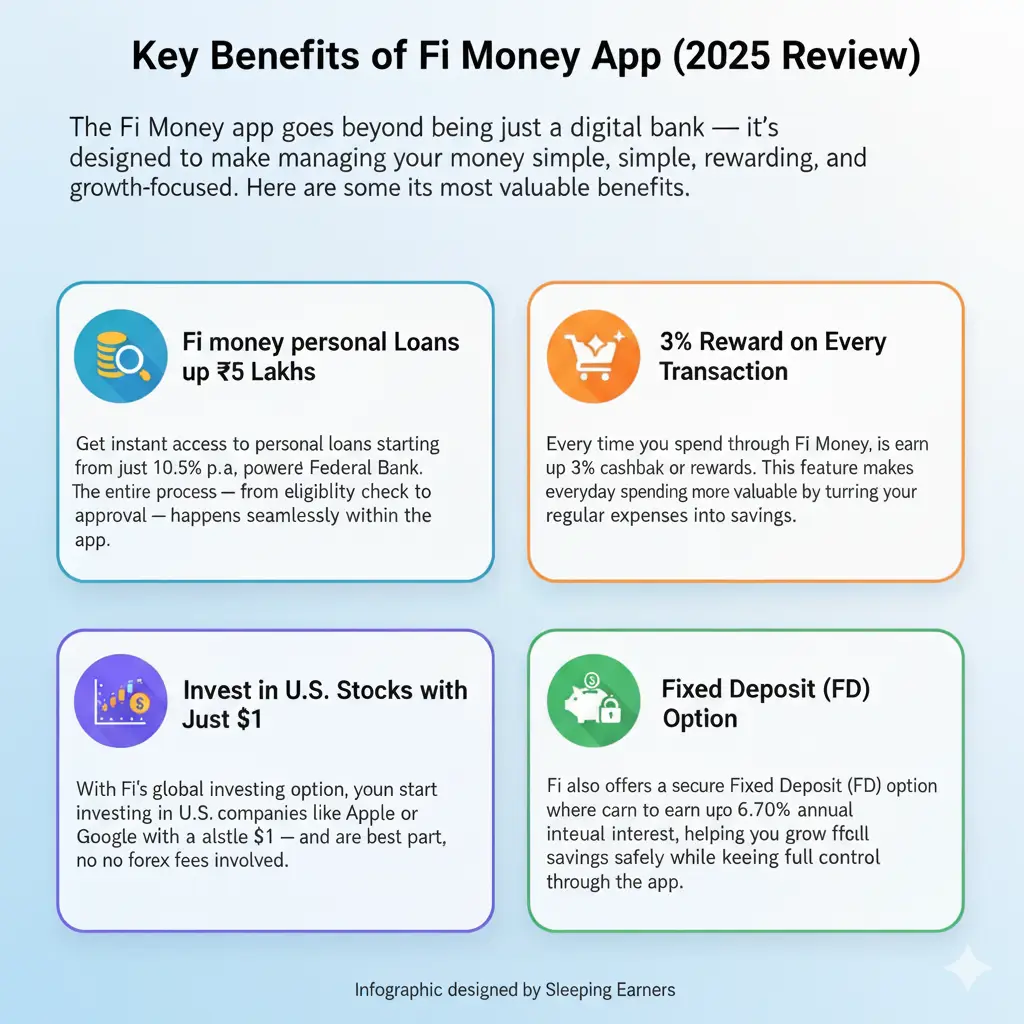

Beyond everyday transactions, Fi Money also offers instant personal loans of up to ₹5 lakhs, powered by Federal Bank, making it one of the most versatile digital banking solutions in India.

Features of the Fi money app:

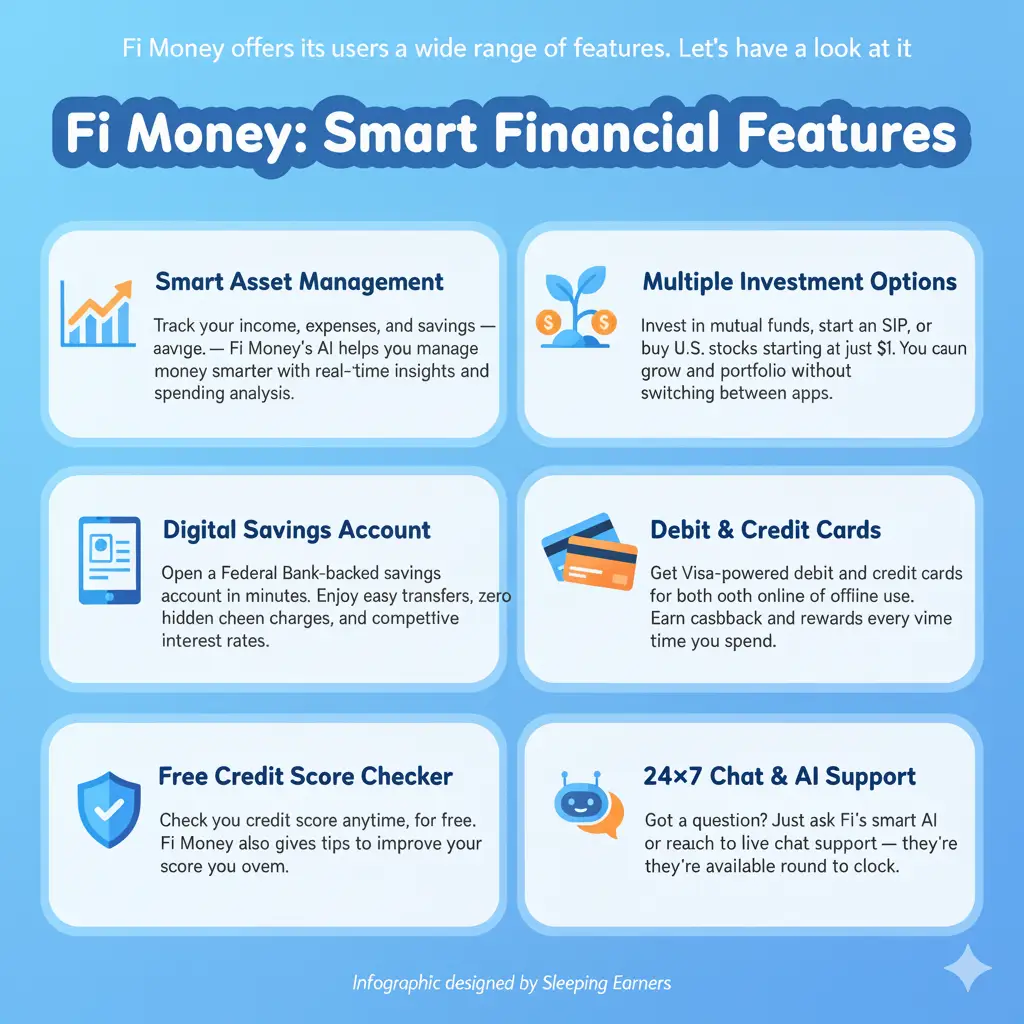

Managing money doesn’t have to be complicated — and that’s where Fi Money comes in.

This digital banking app combines smart AI tools with modern features to help you save, spend, and invest better. From opening a Federal Bank savings account to tracking expenses, earning rewards, and investing in U.S. stocks, Fi Money makes your financial life easier.

The Fi Money Review (2025) provides a comprehensive evaluation of the app’s features and functionalities. It assesses its user experience, cashback offerings, and overall performance in the competitive fintech landscape.

The Fi Money Review (2025) provides a comprehensive evaluation of the app’s features and functionalities. It assesses its user experience, cashback offerings, and overall performance in the competitive fintech landscape.

By analysing user feedback and market trends, this review aims to determine the app’s value proposition and potential for future growth. The insights gathered will be essential for users considering the adoption of Fi Money as their financial management tool.

As you can see, Fi Money brings all essential banking features together in one simple app. Whether it’s using your Fi Money debit or credit card, checking your credit score, or getting insights from AI — everything is designed to help you stay financially organised and confident. (Infographic designed by Sleeping Earners.)

The image below highlights the features of the Fi Money app.

My hands-on notes:

- Account opening: completed video KYC in under 5 minutes.

- Card delivery: Physical debit card arrived in less than 7 days.

- Support response: Live chat replied within 5 minutes during testing.

Key Benefits of Fi Money App (2025 Review)

Fi Money isn’t just another banking app — it’s built to help users grow financially. It offers benefits like instant personal loans, cashback on every spend, and the ability to invest in global markets. It offers a complete package for smart money management.

Overall, the Fi Money app provides an effortless way to save, invest, and earn more. Whether you’re taking a Fi Money personal loan, investing in U.S. stocks, or saving through an FD, the app ensures your money is always working for you. (Infographic designed by Sleeping Earners.)

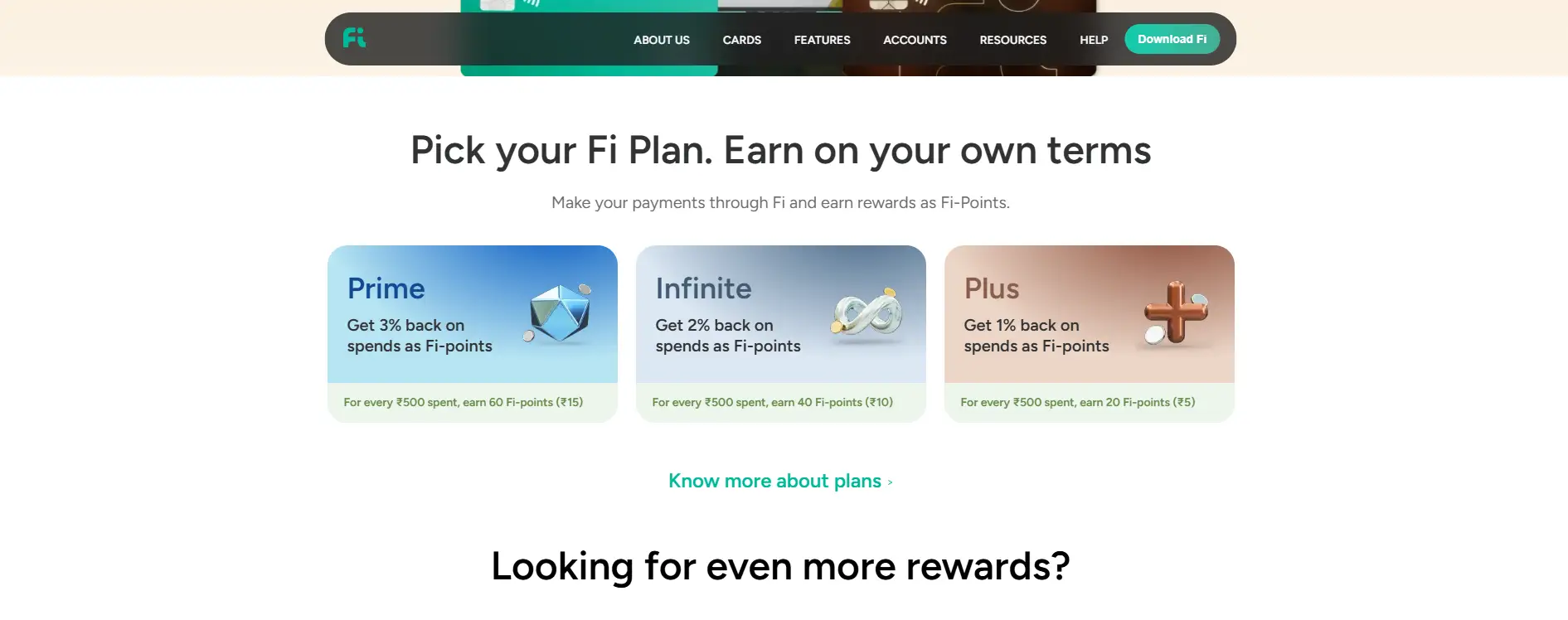

Fi Money Savings Account Plans Comparison 2025

Plan Name | Rewards | Eligibility / Minimum Balance | Forex Charges | Best For |

Prime | 3% back on spends via Fi Points (up to ₹1,000/month) | Maintain ₹1,00,000 in savings account | 0% forex charges (unlimited transactions) | High spenders & frequent travellers |

Infinite | 2% cashback as Fi Points (up to ₹500/month) | Maintain ₹50,000 in savings account | 0% forex fees on global spends | Professionals with moderate usage |

Plus | 1% cashback via Fi Points (up to ₹100/month) | Maintain ₹25,000 minimum balance | 0% forex markup (conditional) | Casual users who want basic rewards |

Standard | Limited rewards and low forex markup | Entry-level Min-KYC account, upgrade anytime | 3.5% forex markup | Beginners testing digital banking |

Regular | No cashback or Fi Points | Maintain ₹5,000 monthly average balance | 3.5% forex markup on global transactions | Minimal users needing simple account access |

The image below highlights the Savings Account Plan as displayed on Fi’s official website.

How to sign up?

If you’re wondering how to start using the Fi Money app, the process is simple and fast. You can begin by downloading the Fi Money app download directly from the Google Play Store or App Store. Once installed, tap on “Get Started” to begin your Fi Money account opening journey.

Enter your mobile number and verify it with the OTP that’s automatically detected. Add your email ID, and congratulations — your Fi Money account has now been created successfully. You can also use this account later for Fi Money login anytime.

How to Open a Fi Money Savings Account?

To open your Fi Money bank account, follow these simple steps:

Go to Banking → Get a Savings Account inside the app.

Enter your full name, PAN number, and date of birth.

Select your employment type, occupation, and annual income.

Tap Next, then fill in your father’s and mother’s names exactly as they appear on their PAN cards.

If you want, you can add a nominee—or skip this step by tapping Continue.

Enter your Aadhaar number or VID, then click Next.

Verify your identity using the OTP sent to your Aadhaar-linked phone number.

Complete video KYC verification by recording a short selfie video and reading aloud the 4-digit number shown on your screen.

After verification, tap Open Account, select your active SIM card, and confirm the name to be printed on your virtual debit card.

That’s it! Your Fi Money savings account will be activated within 1–3 business days, and you’ll also receive your own UPI ID for easy payments and transfers.

How to Get a Fi Money Debit Card or Credit Card?

Once your account is verified, go to the Card icon on the top-right corner of the app.

Tap the Debit Card to view all details about your Fi Money debit card.

If you prefer a physical debit card, click on “Order Now.”

For the Fi Money credit card, visit the same section and tap Credit Card. You can get one even if you don’t have a credit history — by creating a Fixed Deposit (FD).

Your credit limit will be 90% of your FD amount.

Example: If you deposit ₹44,500, your credit card limit will be ₹40,000.

The minimum deposit required to get started is ₹15,000.

To explore all available card types, plans, and benefits, check the Fi Money Cards section or refer to the Fi Money Plans Comparison part of this article.

How to Earn Money with Fi Money?

Looking to earn money from the Fi Money app?

Here’s a quick and simple breakdown of the best ways to make the most out of your Fi Money account

- Use the Fi Money Debit Card for Daily Spending

Every time you make a payment — online or offline — you earn up to 3% cashback or Fi Coins. It’s one of the easiest ways to earn rewards with Fi Money just by using your card. Invite & Earn with Fi Money Referrals

Share your Fi Money referral link with friends. When they complete their Fi Money account opening, both of you get instant bonus rewards.

(Tip: Referral rewards often change, so keep an eye on the app’s offers section!)Earn Interest from Your Fi Money Bank Account

Keep funds in your Fi Money savings account and enjoy competitive interest rates — without any hidden fees. The more you save, the more you earn.Invest Smartly in U.S. Stocks & Mutual Funds

Start investing from as low as $1! With Fi Money investments, you can grow your income passively while managing everything in one app.Create a Fixed Deposit (FD) for Extra Returns

Open an FD directly within the app and earn up to 6.7% annual interest. It’s a safe, effortless way to grow your money with zero paperwork.

Pro Tip: Keep using the app regularly — transactions, savings, and referrals all add up!

Ready to start earning? Download the Fi Money app now, open your Fi Money account, and explore all the ways you can earn with Fi Money today!

If you’re someone who enjoys reading about side hustles, don’t miss our guide on earning from Amazon Kindle publishing.

Frequently Asked Questions (FAQs)

1. Is Fi Money RBI approved?

No, Fi Money is not directly regulated by the Reserve Bank of India (RBI). However, all its banking services are powered by Federal Bank, which is an RBI-licensed and fully regulated bank in India. So, when you open a savings account on Fi Money, it’s essentially a Federal Bank account, ensuring complete regulatory safety.

(Source: Fi Money Official Website)

2. Is Fi Money safe?

Yes, Fi Money is considered safe to use. It uses bank-grade encryption, AI-based fraud monitoring, and two-factor authentication to secure every transaction. Moreover, your deposits are insured by the DICGC (Deposit Insurance and Credit Guarantee Corporation) for up to ₹5 lakhs, just like any other Indian bank.

(Source: Fi Money Security Page)

3. How quickly does Fi Money approve personal loans?

Fi Money provides instant personal loans up to ₹5 lakhs, powered by Federal Bank.

The approval process is fully digital and can be completed in minutes once your KYC and salary verification are done. Interest rates start at 10.5% p.a., depending on your income and credit profile.

For more details, you can also check out this guide by MyMoneyMantra.

4. Does Fi Money offer rewards or cashback?

Yes, Fi Money users can earn up to 3% cashback or rewards on eligible transactions. You can also receive scratch cards, vouchers, and special rewards for completing tasks like setting savings goals, making payments, or investing. These features make it one of the most rewarding neobanking apps in India.

5. Can students use the Fi Money app?

Currently, Fi Money is designed only for working professionals with a regular source of income. Students, homemakers, or unemployed individuals may not be eligible to open an account. This policy is due to its partnership model with Federal Bank, which focuses on salaried individuals.

I don’t want to interrupt you, but if you’re interested in earning money with eBooks, you can check out our complete guide on how to start selling books online.

Conclusion on the Fi money app

The Fi Money app is a smart way to handle your money — from savings and investments to instant Fi Money personal loans. You can open a Fi Money account, get a Fi Money debit card, or even a Fi Money credit card backed by Federal Bank, all in one place. With its clean design, AI insights, and reward system, Fi makes banking effortless and rewarding. If you’re looking for a modern, reliable way to grow and manage your finances, Fi Money is worth a try.

Pros & Cons Of Fi Money App

Pros | Cons |

Intuitive and modern user interface for seamless navigation. | Only available for salaried professionals — not ideal for students or homemakers. |

Offers smart AI tools to track spending and suggest savings. | Limited traditional banking services like RD or credit facilities. |

Earn cashback and rewards on daily transactions. | No physical branches for offline support. |

Option to invest in U.S. stocks and FDs directly within the app. | Some features (like credit card) may not be available to all users. |

Backed by Federal Bank and Visa, ensuring trust and security. | Being relatively new, it still needs time to gain mainstream trust. |

Here’s how Fi Money performs on the Sleeping Earners Trust Scale, which evaluates every app on usability, security, rewards, and innovation.

Sleeping Earners Trust Scale

Fi Money App — evaluated on security, usability, rewards, support, and innovation.

⭐ Verdict: Fi Money stands out as one of the most secure and rewarding neobanks in India, combining smooth usability with reliable banking support.

Reviewed by Sleeping Earners — Independent Financial Review Team

The Sleeping Earner Trust Scale™ evaluates apps based on transparency, usability, safety, rewards, and customer support.

For beginners, we’ve also covered a complete walkthrough on how to earn money online from your phone.

Sources & References

- Fi Money — official features & plans

- Fi Money — fees & forex

- Federal Bank — partnership & banking

- Fi Money on Google Play Store

- MyMoneyMantra — Fi Money loans overview

Sleeping Earners is an independent digital publishing platform founded and run by Ayush Sharma, an SEO practitioner and online monetization strategist with 6+ years of hands-on experience in Amazon KDP, keyword research, and content-driven income models.

Ayush Sharma actively experiments with self-publishing, SEO frameworks, and monetization strategies to understand what works in real conditions. The content on Sleeping Earners is built from first-hand execution, testing, and practical results, not theory or recycled advice.